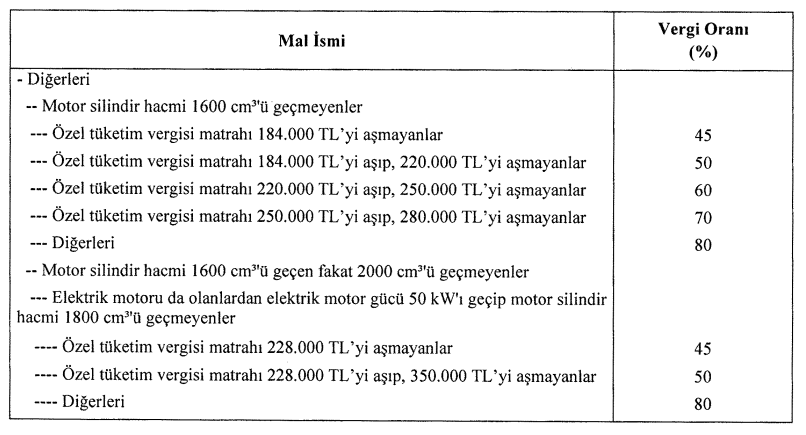

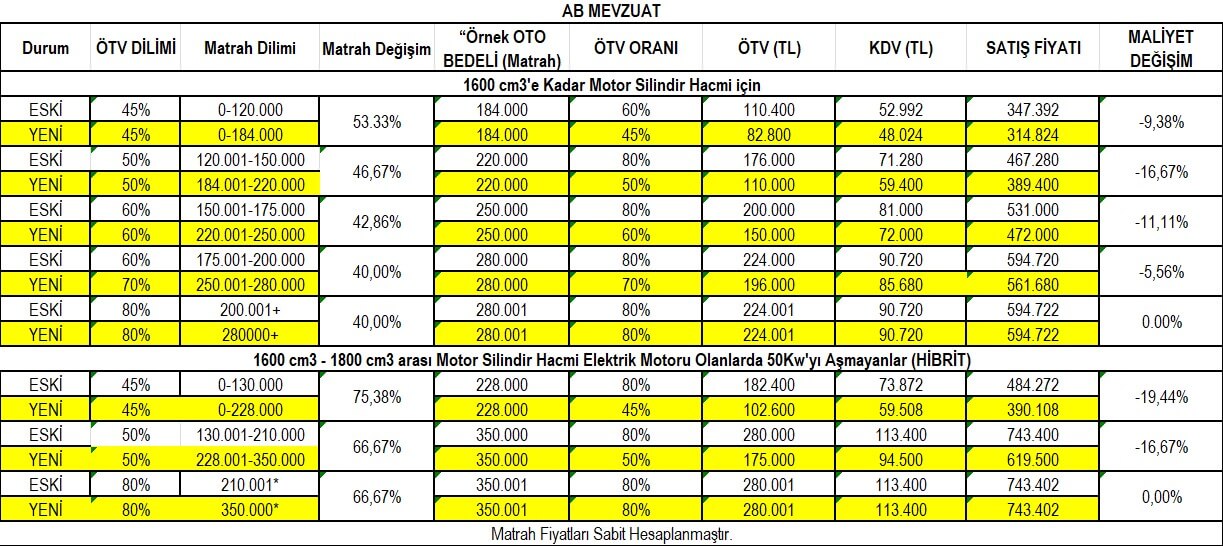

The current automobile tax rates that will affect car prices were published in the Official Gazette dated 24.11.2022 through the decision titled “Decision (Number: 6417) on the Re-determination of the Special Consumption Tax Bases Based on the Special Consumption Tax Rates of Certain Goods Listed in the Annex (II) of the Law on Special Consumption Tax No. 4760” with the new regulation in the SCT base.

How did SCT Rates Change?

SCT reductions are determined based on the base price of vehicle models. The most significant change in the 2022 SCT reductions is the alteration of tax brackets. In previous years, SCT calculations were made based on three tax brackets. However, a new regulation increased the number of tax brackets to five. This means that 60% and 70% tax brackets have been added.

About SCT Exemptions

SCT exemptions are applied in specific circumstances. One such circumstance is having a disability report. However, this exemption varies depending on the percentage of disability. Either an SCT reduction is granted, or complete exemption from SCT is provided. Additionally, there is a limit to the exemption for disabled individuals, which is a maximum of 450,500 TL. Another exemption is available for war veterans or their next of kin. In this case, the next of kin of martyrs must obtain a martyrdom certificate from the social security institution, while veterans need to obtain a disability report. There is no specific limit to be exempt from SCT in these cases, but there is one requirement: the engine displacement must not exceed 1600 cm3.

What is the difference between SCT and Motor Vehicle Tax (MVT)?

Special Consumption Tax (SCT) is the tax incurred when purchasing a vehicle under the scope of Law No. 4760 on Special Consumption Tax. On the other hand, Motor Vehicle Tax (MVT) is an annual tax levied in accordance with Law No. 197 on Motor Vehicles.

When Did the SCT Reduction on New Vehicles End?

The SCT reduction applied to vehicles with engine capacity of 1600 cc and below ended at the end of 2019.

Are there SCT Reductions for New Vehicles?

There is no specific SCT reduction for new vehicles; SCT rates for all vehicles are determined based on the rates listed in Annex II of Law No. 4760 on Special Consumption Tax.

When Do the New SCT Rates Apply?

The new SCT rates have been in effect since January 13, 2022. The latest change in SCT rates was made in accordance with Presidential Decree No. 5096 dated January 12, 2022, and came into effect on January 13, 2022.

Which Vehicles are Eligible for the New SCT Reduction?

As of November 28, 2022, there are no SCT reductions for commercial vehicles.

What is the SCT Reduction for Commercial Vehicles?

As of November 28, 2022, there are no SCT reductions for commercial vehicles.

What are the SCT Benefit Rates for Electric Vehicle Purchases?

While conventional motor vehicles have SCT rates ranging from a minimum of 45% to a maximum of 220%, electric vehicles have SCT rates ranging from a minimum of 10% to a maximum of 60%. Accordingly, an average of 30% reduction can be observed between an entry-level electric vehicle and its conventional motor counterpart, while a savings of approximately 50% can be achieved between a high-end electric vehicle and its conventional motor counterpart.

How Can Individuals with Disabilities Purchase Vehicles Without SCT?

Individuals with disabilities have two different options to purchase vehicles without SCT. Those with disabilities ranging from 40% to 90% can buy vehicles with SCT reduction, but they need to have an H-class driver’s license and a specially equipped vehicle. Individuals with disabilities ranging from 40% to 90% can only use the vehicles purchased with SCT reduction for their own personal use. Those with disabilities above 90% are exempt from SCT, and their immediate family members up to the third degree can use the vehicles purchased without SCT.

Calculation of Vehicle SCT and VAT Rates for 2022

The Special Consumption Tax (SCT) for motor vehicles varies based on engine displacement and sales price, while the Value Added Tax (VAT) is a consistent 18% for all motor vehicles, calculated on the SCT-inclusive amount. The most recent SCT rates were determined in accordance with Presidential Decree No. 5096 published in the Official Gazette on January 13, 2022. The SCT base prices have been updated with Presidential Decree No. 6417 published in the Official Gazette on November 24, 2022.

How Can Veterans and Next of Kin of Martyrs Purchase Vehicles Without SCT?

According to the provision of “Exemption in Vehicle Purchases of Deceased War and Duty Disabled Individuals’ Relatives” under the 1st article of the Regulation Amending the General Communiqué on the Implementation of Special Consumption Tax (II) Numbered List published in the Official Gazette No. 29856 on October 13, 2016, the spouses or children of martyrs, or if they have neither, one of their parents, are exempt from SCT for one vehicle purchase.

SCT Rates for Vehicles with Electric Motors (Hybrids)

The SCT rates for hybrid vehicles (commonly known as vehicles with electric motors) are as follows:

For vehicles with an electric motor power below 50 kW and conventional motor power below 1800 cm3, with SCT base price below 130,000 TL: 45%

For vehicles with an electric motor power below 50 kW and conventional motor power below 1800 cm3, with SCT base price between 130,000 TL and 210,000 TL: 50%

For vehicles with an electric motor power below 50 kW and conventional motor power below 1800 cm3, with SCT base price exceeding 210,000 TL: 80%

For vehicles with an electric motor power exceeding 100 kW and conventional motor power below 2500 cm3, with SCT base price below 170,000 TL: 130%

For vehicles with an electric motor power exceeding 100 kW and conventional motor power below 2500 cm3, with SCT base price above 170,000 TL: 150%

For vehicles with both an electric motor power exceeding 100 kW and conventional motor power exceeding 2500 cm3: 220%

SCT Rates for Electric Vehicles

For passenger-type electric vehicles used for purposes other than cargo transportation, the SCT rates are as follows:

For vehicles with a motor power not exceeding 85 kW: 10%

For vehicles with a motor power between 85 kW and 120 kW: 25%

For vehicles with a motor power exceeding 120 kW: 60%

How is SCT Reduction Calculated for Vehicle Purchase with Disability Report?

The SCT reduction for individuals with a disability of 90% or higher is calculated as follows for a vehicle with a total price of 1,000,000 TL:

Determine the price without VAT: 1,000,000/1.18 = 847,458 TL

Calculate the SCT amount at 80% rate: 847,458/1.80 = 470,810 TL

Calculate the VAT amount based on the price without SCT and find the price with VAT: 470,810 x 1.18 = 555,555 TL

For vehicle purchases with a disability report, a 444,444 TL disability discount is applied for a vehicle priced at 1,000,000 TL.

How is VAT Calculated for Vehicles?

VAT calculation for vehicles is based on the VAT base amount, which is the price of the vehicle including SCT. The applicable VAT rate for all vehicles is 18%. The calculation for a vehicle in the 50% excise tax bracket is as follows:

Price without tax: 200,000 TL

SCT amount: 200,000 x 0.50 = 100,000 TL

VAT base amount: 200,000 + 100,000 = 300,000 TL

VAT amount: 300,000 x 0.18 = 54,000 TL

Total amount with VAT: 300,000 + 54,000 TL = 354,000 TL

How is SCT Applied on Top of VAT for Vehicles?

SCT for vehicles is included in the VAT base amount, meaning the SCT amount also includes VAT. The calculation for the VAT on top of the SCT for a vehicle in the 130% SCT bracket is as follows:

Price without tax: 1,000,000 TL

SCT: 1,000,000 x 1.30 = 1,300,000 TL

VAT on top of the SCT for the vehicle: 1,300,000 x 0.18 = 234,000 TL

VAT and SCT Calculation for Automobiles

The calculation of SCT and VAT for automobiles varies based on the SCT bracket of the vehicle. The calculation is the same for all vehicles, with only the SCT rate changing. The general calculation formula is as follows:

Price without tax x Excise tax rate = Excise tax amount

Price without tax + Excise tax amount = VAT base amount

VAT base amount x 0.18 = VAT amount

VAT base amount + VAT amount = Total price including VAT

SCT and VAT Calculation for Minibuses

The SCT rate for minibuses is 9%, while for buses, it is 1%. The calculation of SCT and VAT for a 100,000 TL minibus is as follows:

100,000 x 0.09 = 9,000 TL (SCT)

100,000 + 9,000 = 109,000 TL (Price including SCT – VAT base amount)

109,000 x 0.18 = 19,620 TL (VAT amount)

109,000 + 19,620 = 128,620 TL (Total price including VAT)

SCT and VAT Calculation for Buses

The calculation of SCT and VAT for a 100,000 TL bus is as follows:

100,000 x 0.01 = 1,000 TL (SCT)

101,000 + 1,000 = 101,000 TL (SCT-included amount – VAT base)

101,000 x 0.18 = 18,100 TL (VAT amount)

101,000 + 18,100 = 119,100 TL (Total price including VAT)

SCT and VAT Calculation for Hybrid Vehicles

The calculation of SCT and VAT for hybrid vehicles, which also have an electric motor, varies based on the SCT bracket of the vehicle. The calculation is the same for all hybrid vehicles, only the SCTrate differs. First, the SCT is calculated based on the tax-free amount, and the amount including SCT becomes the VAT base. A 18% VAT is then applied to the amount including SCT for all passenger vehicles. The general calculation formula is as follows:

Tax-free amount x SCT rate = SCT amount

Tax-free amount + SCT amount = VAT base

VAT base x 0.18 = VAT amount

VAT base + VAT amount = Total price including VAT

SCT and VAT Calculation for Electric Vehicles

The calculation of SCT and VAT for electric vehicles depends on the SCT bracket of the vehicle. The calculation is the same for all electric vehicles, only the SCT rate differs. First, the SCT is calculated based on the tax-free amount, and the amount including SCT becomes the VAT base. A 18% VAT is then applied to the amount including SCT for all passenger vehicles. The general calculation formula is as follows:

Tax-free amount x SCT rate = SCT amount

Tax-free amount + SCT amount = VAT base

VAT base x 0.18 = VAT amount

VAT base + VAT amount = Total price including VAT